Can Banks Freeze Your Account Without Court Orders?

Can banks freeze your account without a court order? Learn when account freezes are legal, when they become unlawful, and what remedies borrowers have in India.

Vani Jain holds a BBA (Bachelor of Business Administration) degree from Kolkata. While working, she developed a keen interest in writing blogs, eventually helping people understand loan terms, EMI schedules, and more.

Can banks freeze your account without a court order? Learn when account freezes are legal, when they become unlawful, and what remedies borrowers have in India.

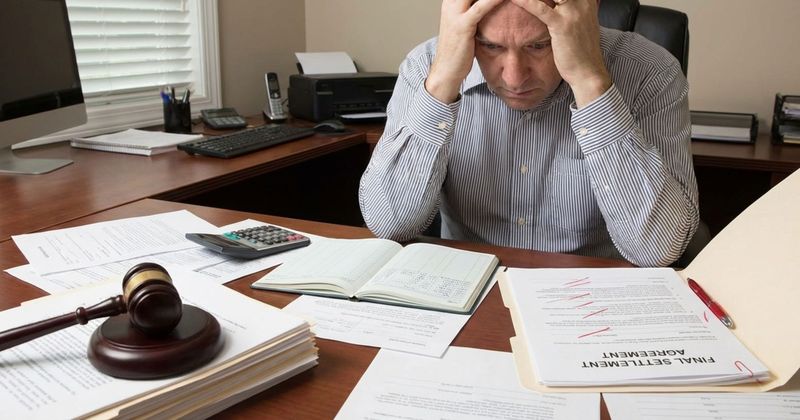

Debt settlement is not complete without proper documentation, and relying on verbal assurances can expose borrowers to legal risks. This article explains common post-settlement pitfalls, CIBIL errors, recovery calls, and why written settlement and closure letters are essential to legally close a loan and prevent future claims.

Learn simple repayment strategies to close a 15-year loan much faster. Step-up EMIs, lump-sum prepayments, and small extra payments can together cut years off your tenure.

Learn key signs of falling into a debt trap and practical ways to overcome it. Manage debt wisely and protect your financial future.

Loan apps misusing morphed images to threaten borrowers are a growing menace. Learn your legal rights, how to file complaints, and claim compensation.

Fraud loan apps don’t just trap you with high interest rates — they invade your privacy, misuse your contacts, and blackmail borrowers into repayment. Learn how to protect yourself and what steps to take if you’ve already been targeted.

Learn how Indian law protects you when loan apps misuse your gallery or contacts, including your rights under the IT Act, DPDP Act, and Constitution.

Learn how to secure a legally binding credit card settlement agreement in India and protect yourself from future claims, harassment, or legal issues.

Learn the top 5 warning signs of illegal recovery practices by agents and how to protect your rights with legal steps and RBI support.

A bounced EMI cheque in India can trigger legal action under Section 138 NI Act. Understand the law, your rights, and how to respond effectively.

Personal loan growth has slowed, signaling a shift in the credit landscape. As banks tighten lending, borrowers must rethink their debt strategies. This slowdown offers a crucial chance to consolidate debt, build savings, and improve financial literacy. Learn how to adapt your borrowing habits in this changing economic climate.

Are you overpaying on your home loan? Discover how RBI rules, EMI tweaks, and proactive steps can help you save big. From reducing interest costs to smart lender switches, take control of your finances today. Is your home loan working as hard as it should for you?

Our experienced debt resolution team is here to help you resolve loan EMI problems, stop recovery harassment, and settle credit card or personal loan dues with clarity, care, and confidence.

Connect with our Experts Now