Introduction

In today’s digital era, recovery agents have shifted from door-to-door pressure tactics to harassing borrowers through WhatsApp, SMS, and emails, using threats, blackmail, and character defamation. These acts are not only unethical but also illegal under Indian law.

This blog outlines the legal remedies borrowers can pursue and explains how to file a police complaint step-by-step.

Digital Harassment by Recovery Agents

Common forms of digital intimidation include:

- Repeated WhatsApp abuse and offensive messages

- Threatening or blackmailing emails using vulgar or coercive language

- Public shaming by contacting friends, colleagues, or relatives

- Use of morphed images or abusive material

- Threats of arrest or seizure without a legal notice/basis

Such acts violate both RBI regulations and the legal laws of India.

RBI Guidelines on Recovery Practices

The Reserve Bank of India (RBI) has issued strict norms for ethical recovery:

- Recovery agents must identify themselves professionally

- No abusive or coercive language is permitted

- Calls must be made only between 7 a.m. to 7 p.m.

- Borrowers’ privacy must be respected

Violation of these norms may result in penalties or cancellation of licenses for the lender or the recovery agency.

Relevant Legal Provisions

Under the Indian Penal Code (IPC):

- Section 503 – Penalty for criminal intimidation

- Section 506 – Punishment for criminal intimidation

- Section 499/500 – Defamation by disgrace or injury to reputation

- Section 509 – Verbal or gestural abuse to the modesty of an individual

Under the Information Technology Act, 2000:

- Section 66C & 66E – Unauthorized access to personal data, breach of privacy

- Section 67 – Transmission of obscene or harmful digital content

Step-by-Step Guide: Filing a Police Complaint

Step 1: Gather Evidence

Collect and safely keep the following:

- WhatsApp chats

- Screenshots of messages

- Audio/video recordings

- Emails and timestamps

- Contact details of the harassing agent

Backup your data securely (cloud/drive/email).

Step 2: Draft a Written Complaint

Your complaint should include:

- Your name, address, and contact information

- Name of the lending bank/NBFC

- Name and contact of the recovery agent (if known)

- Incident description with proper dates and evidence to back your case

Step 3: File at the Nearest Police Station

- Visit your local police station

- File a complaint under relevant IPC and IT Act sections

- Request an FIR

- If refused, demand a written explanation

Step 4: File Online at Cyber Cell

- Visit the National Cyber Crime Reporting Portal

- Select: Financial Fraud/Online Harassment

- Submit your complaint with all digital proof

Step 5: Escalate if Ignored

If local police inaction persists, escalate to:

- Superintendent of Police (SP)

- District Magistrate

- State Human Rights Commission

- Judicial Magistrate (under Section 156(3), CrPC)

Other Remedies and Support Options

- RBI Ombudsman Complaint: File online at cms.rbi.org.in

- National Consumer Helpline: 1800-11-4000 | consumerhelpline.gov.in

- Consumer Forum: File for harassment, mental agony, or deficiency of service

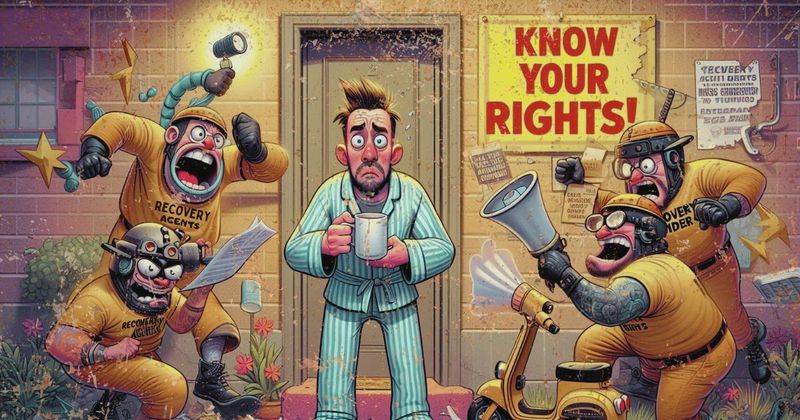

Finally, Know Your Rights And Fight Back!

Digital harassment by recovery agents is a violation of your privacy, dignity, and rights. India’s legal framework, supported by RBI regulations and criminal law, empowers you to take strict legal action.

Don’t stay silent. Document, escalate, and report.

Your action today can help curb inhumane and illegal recovery practices tomorrow.