“2-minute ka kaam hai boss! App kholo, form bharo, aur loan approved!

Bas swipe karo aur paise pocket mein!”

Sounds easy, right?

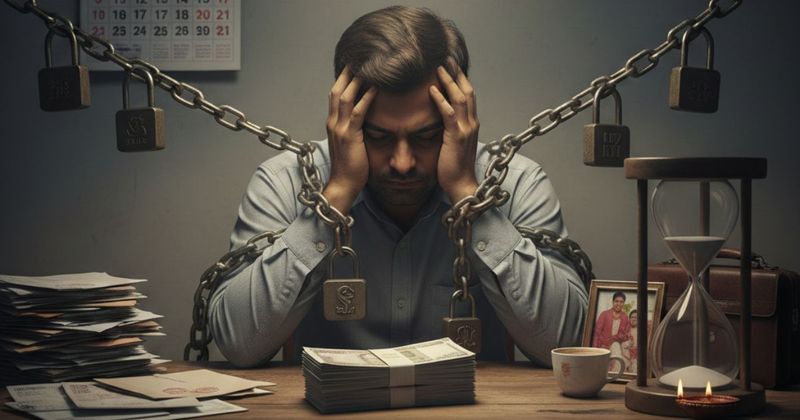

But that same 2-minute decision can become a 20-year burden , endless EMIs, constant financial tension, and sleepless nights.

In today’s digital lending world, instant approval and Buy Now, Pay Later schemes are everywhere. But behind that “easy EMI” offer lies a financial trap that many people only realise years later.

Understanding the Real Cost of Borrowing

A loan is not free money , it’s your future income that you’re spending today.

Every EMI you pay includes not just the principal, but also interest , often compounding over time.

Banks and NBFCs design offers that appeal to your emotions , new phone, car, holiday, lifestyle upgrade. They sell comfort and convenience, but what they actually create is a fixed monthly liability that eats into your savings and limits your financial flexibility.

Result?

- A large chunk of your salary goes into EMIs

- Little to no money left for emergencies

- High interest rates compound your debt faster than you can repay it

👉 If you’re already struggling with EMIs, read our guide:

🔗 https://expertpanel.org/blog/loan-resolution-process-india/ — expertpanel.org

3 Golden Rules Before You Take a Loan

Simply saying “don’t take loans” is unrealistic. Loans can be powerful tools — if used wisely.

Before signing any loan agreement, apply these 3 practical tests:

1. Greed vs Need Test

Ask yourself: “Is this a need or just a want?”

Buying a car for daily commute? Possibly a need. Buying a new iPhone on EMI? That’s likely a want.

2. Future Salary Lock Test

After paying EMIs, will you still have enough for:

● Emergency savings

● Health expenses

● Investments for growth

If your EMI eats up more than 30–35% of your take-home income, you’re walking into a debt trap.

3. Reverse EMI Saving

Before taking a loan, try saving the same EMI amount for 6–12 months.

If you can’t save it consistently, repaying that EMI long-term will be even harder.

This method builds both financial discipline and reality-check awareness.

Loan Isn’t a Sin , But Greedy Borrowing Is a Trap

Loans are not evil. In fact, home loans or education loans can be growth enablers when managed smartly.

But when loans are driven by impulse, greed, or peer pressure , they become financial bondage.

Use credit to create assets, not liabilities.

Understand your repayment ability before signing that “2-minute approval” deal.

🔗 Know Your Rights & Legal Support

If you are facing harassment from recovery agents, remember — you are protected under RBI guidelines. Banks cannot use abusive or coercive tactics for loan recovery.

👉 Read the official RBI notification on recovery agents

RBI — Guidelines on Recovery Agents | Reserve Bank of India

👉 Understand your rights under ExpertPanel’s guide on red flags and RBI rules

ExpertPanel: RBI Guidelines on Recovery Agents & Borrower Rights | ExpertPanel

👉 Lodge a complaint with the RBI / Banking Ombudsman

● RBI’s Online Complaint System (CMS): https://cms.rbi.org.in

● RBI Complaint Page: RBI — Complaints | Reserve Bank of India

● Government portal to lodge Ombudsman complaint: Lodge Complaint with Banking Ombudsman | India Government Services