How Loan Resolution Helps You Avoid Legal Notices

Understand how loan resolution can help borrowers manage repayment stress, improve communication with lenders, and reduce the risk of legal notices in India.

Browse 17 articles related to Loan Settlement

Understand how loan resolution can help borrowers manage repayment stress, improve communication with lenders, and reduce the risk of legal notices in India.

Understand what personal loan resolution means, how the process works, and the simple steps borrowers in India can follow to manage repayment challenges.

Confused between loan restructuring and settlement? Understand when settlement may be a more practical option and how it helps during financial stress.

Learn how to rebuild your finances after a loan settlement. Practical steps to regain stability, rebuild trust, and handle money better after debt settlement.

Learn why working with a debt settlement agency may make debt management easier than handling it alone. Understand how expert guidance can reduce stress.

Thinking of buying a bank auction property? Discover the risks, buyer safeguards, loan settlement tips, and legal remedies with the help of debt resolution specialists.

Struggling with loan or credit card debt? Learn how loan settlement works under RBI guidelines, its impact on your credit score, and how it can give you financial relief.

Inconsistent interest rates and late fees can silently increase EMI costs for Indian borrowers. Learn how to manage these risks with knowledge, planning, and timely action.

Can recovery agents take your home or salary? Know your rights, what they legally can and can’t do, and how to protect yourself from harassment.

Understand RBI’s rules for recovery agents, what counts as harassment, and the legal remedies borrowers can use to protect themselves from unfair debt collection practices.

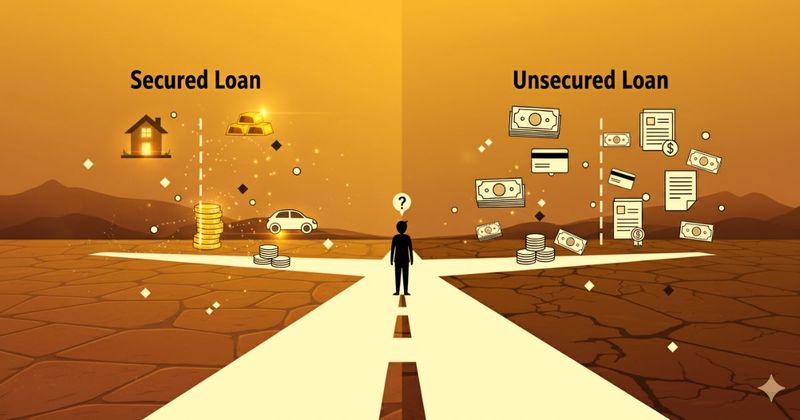

Expert panel explains secured vs unsecured loans in India, highlighting benefits, risks, eligibility, and repayment. Know which loan suits your financial goals without risking a debt trap

Medical emergencies often push borrowers into debt defaults, but being sick is not a crime. With Expert Panel, learn your legal rights, protections under Indian law, and how to seek relief from harassment and unfair recovery practices while dealing with medical debt.

Our experienced debt resolution team is here to help you resolve loan EMI problems, stop recovery harassment, and settle credit card or personal loan dues with clarity, care, and confidence.

Connect with our Experts Now