How Loan Resolution Helps You Avoid Legal Notices

Understand how loan resolution can help borrowers manage repayment stress, improve communication with lenders, and reduce the risk of legal notices in India.

Browse 8 articles related to Loan Resolution

Understand how loan resolution can help borrowers manage repayment stress, improve communication with lenders, and reduce the risk of legal notices in India.

Facing business losses can be stressful and overwhelming. Learn how to stay calm, regain control, manage cash flow, renegotiate liabilities, and rebuild stability with practical steps after a business setback.

Discover the most common myths about credit card loan settlement in India. Learn what’s true, what’s misunderstood, and how settlement works with professional guidance.

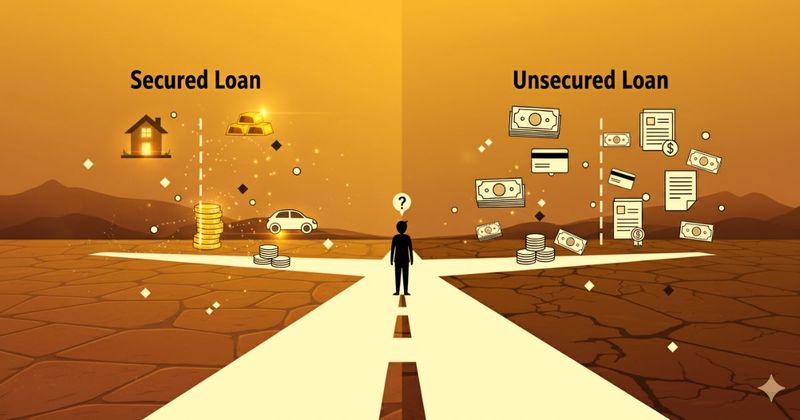

Expert panel explains secured vs unsecured loans in India, highlighting benefits, risks, eligibility, and repayment. Know which loan suits your financial goals without risking a debt trap

IPL betting may look exciting, but statistics show that 90% of people lose their money, and many end up borrowing through loans to cover losses. This cycle leads to debt traps, harassment, and even tragic consequences.

Facing WhatsApp harassment by recovery agents? Learn what counts as illegal, how RBI protects you, and the legal actions you can take to stop it.

Small loans are fueling India’s consumption boom, enabling lifestyle upgrades and reshaping shopping habits. But can easy credit balance aspirations and financial health?

Urgent loans provide quick funds for emergencies like medical bills or car repairs. This guide covers their pros, cons, and alternatives, helping you make informed choices and improve financial readiness for future needs.

Our experienced debt resolution team is here to help you resolve loan EMI problems, stop recovery harassment, and settle credit card or personal loan dues with clarity, care, and confidence.

Connect with our Experts Now